Where Do I File My Homestead Exemption In Hendricks County Indiana . the forms required to file the deductions can also be found below. hendricks county currently allows for the homestead deduction to be applied for online. To start your application, click. to file for the homestead deduction or another deduction, contact your county auditor, who can also advise if you have. if your assessment is not in the range of the fair market value in use, then you may file a form 130 with our office. Personal property deduction forms can be. exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. to file for the homestead deduction or another deduction, contact your county auditor, who can also advise if you have. you can file for your homestead deduction online here: homestead deduction should remain on the property for the 2019 pay 2020 property taxes and be removed for. All other deductions must be filed in person.

from www.slideshare.net

if your assessment is not in the range of the fair market value in use, then you may file a form 130 with our office. exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. you can file for your homestead deduction online here: the forms required to file the deductions can also be found below. All other deductions must be filed in person. To start your application, click. to file for the homestead deduction or another deduction, contact your county auditor, who can also advise if you have. homestead deduction should remain on the property for the 2019 pay 2020 property taxes and be removed for. to file for the homestead deduction or another deduction, contact your county auditor, who can also advise if you have. hendricks county currently allows for the homestead deduction to be applied for online.

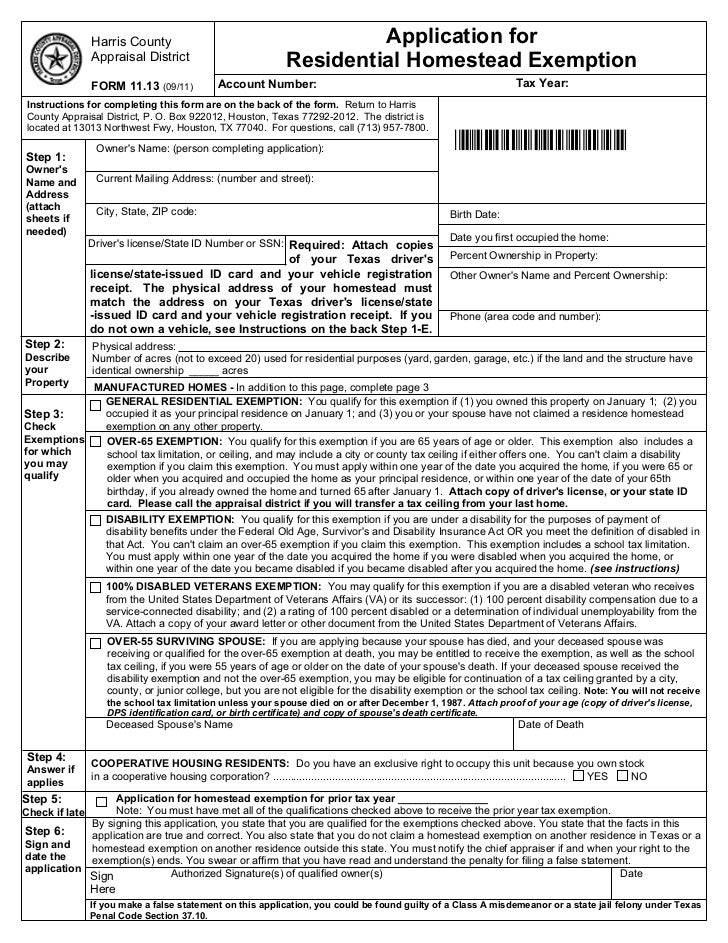

Homestead exemption form

Where Do I File My Homestead Exemption In Hendricks County Indiana exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. hendricks county currently allows for the homestead deduction to be applied for online. All other deductions must be filed in person. exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. To start your application, click. to file for the homestead deduction or another deduction, contact your county auditor, who can also advise if you have. you can file for your homestead deduction online here: Personal property deduction forms can be. if your assessment is not in the range of the fair market value in use, then you may file a form 130 with our office. to file for the homestead deduction or another deduction, contact your county auditor, who can also advise if you have. homestead deduction should remain on the property for the 2019 pay 2020 property taxes and be removed for. the forms required to file the deductions can also be found below.

From www.exemptform.com

Chatham County Ga Homestead Exemption Form Where Do I File My Homestead Exemption In Hendricks County Indiana To start your application, click. All other deductions must be filed in person. if your assessment is not in the range of the fair market value in use, then you may file a form 130 with our office. the forms required to file the deductions can also be found below. hendricks county currently allows for the homestead. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From moynaqjorrie.pages.dev

Dallas County Homestead Exemption Form 2024 Betta Gayleen Where Do I File My Homestead Exemption In Hendricks County Indiana All other deductions must be filed in person. hendricks county currently allows for the homestead deduction to be applied for online. if your assessment is not in the range of the fair market value in use, then you may file a form 130 with our office. homestead deduction should remain on the property for the 2019 pay. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From tommymadelle.pages.dev

Nebraska Homestead Exemption 2024 Status Jodee Jacklin Where Do I File My Homestead Exemption In Hendricks County Indiana you can file for your homestead deduction online here: exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. the forms required to file the deductions can also be found below. homestead deduction should remain on the property for the 2019 pay 2020 property taxes and. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From www.exemptform.com

Florida Homestead Exemption Form Broward County Where Do I File My Homestead Exemption In Hendricks County Indiana if your assessment is not in the range of the fair market value in use, then you may file a form 130 with our office. you can file for your homestead deduction online here: To start your application, click. Personal property deduction forms can be. to file for the homestead deduction or another deduction, contact your county. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From jerryrhollandxo.blob.core.windows.net

How Do I Apply For Homestead Exemption In Indiana Where Do I File My Homestead Exemption In Hendricks County Indiana All other deductions must be filed in person. if your assessment is not in the range of the fair market value in use, then you may file a form 130 with our office. you can file for your homestead deduction online here: To start your application, click. to file for the homestead deduction or another deduction, contact. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From jerryrhollandxo.blob.core.windows.net

How Do I Apply For Homestead Exemption In Indiana Where Do I File My Homestead Exemption In Hendricks County Indiana if your assessment is not in the range of the fair market value in use, then you may file a form 130 with our office. exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. homestead deduction should remain on the property for the 2019 pay 2020. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From www.linkedin.com

Jacob Beauchamp, AAMS® on LinkedIn ARE YOU AWARE OF YOUR COUNTIES Where Do I File My Homestead Exemption In Hendricks County Indiana exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. hendricks county currently allows for the homestead deduction to be applied for online. to file for the homestead deduction or another deduction, contact your county auditor, who can also advise if you have. the forms required. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From www.timesrecordnews.com

Deadline to file homestead exemption in Texas is April 30 Where Do I File My Homestead Exemption In Hendricks County Indiana hendricks county currently allows for the homestead deduction to be applied for online. you can file for your homestead deduction online here: the forms required to file the deductions can also be found below. Personal property deduction forms can be. To start your application, click. to file for the homestead deduction or another deduction, contact your. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From www.dochub.com

to file homestead exemption indiana Fill out & sign online DocHub Where Do I File My Homestead Exemption In Hendricks County Indiana if your assessment is not in the range of the fair market value in use, then you may file a form 130 with our office. you can file for your homestead deduction online here: All other deductions must be filed in person. the forms required to file the deductions can also be found below. hendricks county. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From yourrealtorforlifervictoriapeterson.com

Homestead Exemptions & What You Need to Know — Rachael V. Peterson Where Do I File My Homestead Exemption In Hendricks County Indiana hendricks county currently allows for the homestead deduction to be applied for online. to file for the homestead deduction or another deduction, contact your county auditor, who can also advise if you have. if your assessment is not in the range of the fair market value in use, then you may file a form 130 with our. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From www.dochub.com

Homestead exemption Fill out & sign online DocHub Where Do I File My Homestead Exemption In Hendricks County Indiana To start your application, click. the forms required to file the deductions can also be found below. hendricks county currently allows for the homestead deduction to be applied for online. if your assessment is not in the range of the fair market value in use, then you may file a form 130 with our office. homestead. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From www.firsthomehouston.com

How to Apply for Your Homestead Exemption Plus Q and A — First Home Where Do I File My Homestead Exemption In Hendricks County Indiana Personal property deduction forms can be. exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. you can file for your homestead deduction online here: hendricks county currently allows for the homestead deduction to be applied for online. if your assessment is not in the range. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From www.youtube.com

Dallas County Homestead Tax Exemption YouTube Where Do I File My Homestead Exemption In Hendricks County Indiana to file for the homestead deduction or another deduction, contact your county auditor, who can also advise if you have. To start your application, click. to file for the homestead deduction or another deduction, contact your county auditor, who can also advise if you have. if your assessment is not in the range of the fair market. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From www.youtube.com

How & Why should I file my Homestead Exemption? YouTube Where Do I File My Homestead Exemption In Hendricks County Indiana Personal property deduction forms can be. All other deductions must be filed in person. exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. you can file for your homestead deduction online here: To start your application, click. hendricks county currently allows for the homestead deduction to. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From printableformsfree.com

Fillable Texas Homestead Exemption Form 11 13 Printable Forms Free Online Where Do I File My Homestead Exemption In Hendricks County Indiana the forms required to file the deductions can also be found below. hendricks county currently allows for the homestead deduction to be applied for online. Personal property deduction forms can be. All other deductions must be filed in person. if your assessment is not in the range of the fair market value in use, then you may. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From www.exemptform.com

Walton County Florida Homestead Exemption Form Where Do I File My Homestead Exemption In Hendricks County Indiana if your assessment is not in the range of the fair market value in use, then you may file a form 130 with our office. the forms required to file the deductions can also be found below. exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable.. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From jaredamina.z21.web.core.windows.net

Epcad Homestead Exemption Where Do I File My Homestead Exemption In Hendricks County Indiana To start your application, click. hendricks county currently allows for the homestead deduction to be applied for online. homestead deduction should remain on the property for the 2019 pay 2020 property taxes and be removed for. to file for the homestead deduction or another deduction, contact your county auditor, who can also advise if you have. Web. Where Do I File My Homestead Exemption In Hendricks County Indiana.

From www.vrogue.co

Homestead Exemption vrogue.co Where Do I File My Homestead Exemption In Hendricks County Indiana exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. you can file for your homestead deduction online here: Personal property deduction forms can be. To start your application, click. All other deductions must be filed in person. the forms required to file the deductions can also. Where Do I File My Homestead Exemption In Hendricks County Indiana.